Financials Training Guide

Assumed Knowledge

Before you attempt the General Ledger training guide, you must complete:

The skills covered by the training guide segments listed above are taken as assumed knowledge. Do not proceed with this segment of the training guide until you have reviewed the training guide segments listed above and successfully completed the skills test at the end of those earlier training guide segments. You can't successfully complete this segment of the training guide without the skills covered in those earlier segments. There are no effective short-cuts! Don't sell yourself short by skipping those essential skills.

Financials Training Overview

The key to using the Financial training guide is planning which parts of the guide are important to you:

The first time you read through the financials training guide, do so quickly, looking for points and features of interest to you. We advise you to look through all the financials features, even if you have to print this page or export it to work. Then tick off which features you want to use in your business. At the end of this first pass you should have a list or the points you need to learn. The work out which people in your business need to know each of the identifies points of interest.

Then go through the Financial training guide a second time. Ensuring you make sure the right people in your business learn the right financial procedures. When working through a second time focus on detail, watch the videos and read the training material for each point of interest to your business.

For a more complete overview of Readysell financials see: Readysell Payroll and Financials.pptx

General Ledger Overview

- High end financial features such as live profit and loss report right on your screen, charting performance trends and ratios with extensive customisation capabilities

- Tight Control over Financial Period.

- Roll Base Security in isolating what user has access to the financial module.

- Audit Trail, limited for Financial Accounts

- Drill down Back to Source Transaction.

- Full set Standard Account Reports. Best practice is to download extras from the store eg (All sites), (multiple sites)

- Flexible Tree Bass Chart of Accounts. Use View of Accounts with Balances on the Profit & Loss tree view

- GST Reporting using GST Items and GST Batch

- Standard and Auto Reversing Journals.

Accounts Overview

The 7 Basic Accounting Types (in order) are:

- Assets - Things you own

- Liabilities - Things you owe

- Equity - Owners Stake in Company

- Revenue - Income through Sales of the Products of the Business

- Costs of Goods Sold - Costs to provide the service or to manufacture or acquire the product the business sells

- Expenses - Things that are paid for that are consumable, they have no lasting value but are part of the cost of running a business

- Other Revenue and Expenses - Revenue and Expenses that are unusual cases and are not directly related to the business product and are not usual costs of running a business.

Financials Key Skills

Basic financial processes

| Star Rating | How To | Skills Test | Video (Before using any videos, don't get stuck with viewing a tiny image, see How To Play Videos ) |

|---|---|---|---|

| ***** | Entering Manual Bank Deposits | This transaction is only for Deposits that appear on a bank statement that have not been entered on any card of any type. Click New, Enter the date that is on Bank Statement, Tender,Bank Account, Description, Payment Reference, Select the correct General Ledger Account, Value and Tax code. Click on Finalise. Transaction Type = CBKDEP | |

| Entering Manual Bank Payments | This transaction is only for Payments that appear on a bank statement that have not been entered on any card of any type. Click New, Enter the date that is on Bank Statement, Tender,Bank Account, Description, Payment Reference, Select the correct General Ledger Expense Account, Value and Tax code. Click on Finalise. Transaction Type = CBKPAY | ||

| Creating a Recuring Bank Payment | Your regular bank payments can be handled automatically as reccuring bank payments. Let's say you have to pay rent every month. You can just setup a reccuring payment and the system will create the required payment based upon the rules that have been set up on the recurring payment itself. The recurring payment that has been set up will stand for the master payment and the status will always be OPEN. In addition, weekly payments can also be automated. Best practice is to have your bank perform a direct debit on a regular basis. Then use a bank reconciliation rule to import the payment into your system from the bank statement. If you are not using automated bank reconciliation import or if you can't get the bank to setup a direct debit to handle your regular payment requirement, then you would use this feature to create the payment from within Readysell. | ||

| Entering a Bank Transfer from One Bank Account to Another Bank Account | A Bank Transfer is a electronic payment that is made directly from your bank account to another bank account. Eg a payment made from your master bank account to your Visa Credit Card Account.- (in other words a bank-to-bank transfer/payment). The contra account for this bank transfer is 11535. This account is a mandatory account. Please do not change this account id to stand for anything else within the chart of accounts. | ||

The Bankings Modules contains the movements of all Money in and out of any General Ledger Account that is has been set up and flagged as a Bank Account. It is a list of all Payments Received being from a Customer, Cash Sales, Cheques, Eftpos, Direct Deposits and Payments made to a Supplier along with all Banking Deposits, Banking Payments and Banking Transfers. Please note, there is a flag on the genera ledger chart of accounts that stands for 'Is Bank'. No manual entries can be added through the 'Bankings' Module. . | |||

Before you commence your first Bank Reconcilation, ensure that Readysell has set up the First Bankrec to stand for you closing bankrec from your old system. A Bank Reconciliation is a process that explains the difference between the bank balance shown in a companys bank statement, as supplied by the bank, and the corresponding amount shown in the organization's own [accounting] records at a particular point in time. | |||

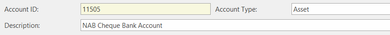

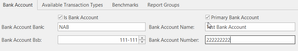

The purpose of the Chart of Accounts is to provide a listing of the different accounts used by the organisaion according to their intended purpose. Readysell has a set Chart of Accounts, the Chart is reviewed by the Site as additonal Accounts may need to be modified/added. The AccountIDs are not to be changed as they are mandatory and used in various areas within Readysell. Adding and Modifying Accounts is the way to go. Before you start trading with Readysell you must adjust the settings on your main bank account and setup any additional bank accounts! As the bank account details from your main bank account print on your sale invoices!

Setting up the Primary Bank account and Other Bank Accounts.You can only have 1 Primary Bank Account but many Bank Accounts.

For Visa/Credit Card accounts, Readysell has a list in the Liability area starts at 34000

| |||

Adding/Removing Transaction Types from a General Ledger Chart of Account | Readysell allows you to restrict certain transaction types from a General Ledger Account to reduce the chance of errors. | ||

General ledger budget figures let you measure actual performance against your expectations. The general ledger figures are of not much use on their own. At some point you have to compare your general ledger results against some expected standard. The budget figures allow you to record your expected results, your business plan, in advance. Then to monitor actual performance to see if you are meeting your goals. All well run business enterprises have a business plan and compare results against the plan. Best practice is to enter general ledger budgets, at least on a few key accounts like revenue and expenses, at the start of the year. Then every month check your results against your expectation. If the business is not performing as expected, you will have time to do something about it before the end of the year. | |||

A Manual General Ledger Journal is only entered when you need to record a nonroutine transactions, such as depreciation, sale of an asset, etc. When inserting a general journal you must enter the account to be debited and the account to be credited and the amounts. Once a transaction is recorded in the general journal, the amounts are then posted to the appropriate accounts for that period. If a source transaction has been posted to the wrong general ledger account or the value of the transaction is incorrect, a general ledger journal is not the way to go. You must go back to the source transaction and fix it from there. Transaction Type = 'GLJMAN' | |||

| Financial Reports | Select reports from the navigation panel, go to form reports then select the "financial reports" category. Run a profit and loss and a balance sheet report. |

Advanced Financial Processes

Cash Book

Bank Deposits

- Creating a Recuring Bank Payment

- Entering a Manual Bank Payment

- Reversing an existing bank payment

- Processing payroll by importing into bank payments

- Cancelling a Recurring Bank Payment

- How to handle reimbursements for purchasing from personal bank Account

- Entering a Bank Transfer

- Setting Up General Ledger Account for Contra

- Entering a Bank Transfer Readysell Lite Stores

- Reversal of a Bank Transfer

- Performing your first bank reconciliation just to bring in the opening balances for bank reconciliations

- Performing a bank reconciliation manually (not importing the bank statement)

- Setting up and using automatic bank reconciliations

- Automated Bank Reconcilation from a imported Bank Statement

- Reversing a bank reconciliation

General Ledger

Accounts

- Creating/ Modifying a general ledger account

- Restricting Transaction types from a General Ledger Account

- Drilling down to transaction details from an account

- Entering General Ledger Budget Figures

- Understanding wages in the general ledger

- Finding Bank Balance

- Changing a postable account to be a header account

- Closing a General Ledger Account

- Maintaining and assigning Tax Codes to Transaction Types within Chart of Accounts

- Creating a type of Bank Account and linking a Tender

- Printing the Chart of Accounts

Journals

- Entering a New General Journal

- Reversing an existing general journal

- Auto Reversing General Ledger Journals

Standing Journals

Tax

GST Batches

- Running your GST batch For Accrual Basis

- Checking for Incorrect Tax Codes with Transaction Types

- Running your GST Batch for Cash Basis

Backdating Cost on Shipments

Going Live with Readysell Financials Including Entering Initial Balances

Initial setup of financials including brought forward balances

Budgets

Importing budgets

Importing General Ledger Budgets Using the Import/Export Module

Checking budgets have imported correctly

After importing the budgets, run form report F-009 in order to check that the budgets have been imported correctly.

Monthly checks to see if we are meeting our budgets

Run form reports F-Profit & Loss Variance (by site); F-006 Balance sheet variance (by site)

GST

For Readysell Lite:

For full Readysell:

Reports

Customer Trial Balance (Summary)

Customers End Of Month Procedure

Supplier Trial Balance (Summary)

Suppliers End Of Month Procedure

How the General Ledger Financial Reports display credits.

Learn more

Setting up automatic email of statements

Procedure for running financials from a separate software package.