GST Items

Overview

The Goods and Services Tax (GST) in Australia is a Value Added Tax (VAT) on the supply of goods and services in Australia. The GST is levied at a flat rate of 10% on most goods and services, apart from GST exempt items, and input taxed goods and services. For GST purposes a tax period may be monthly, quarterly or annual and refers to how frequently you lodge your activity statement You use an activity statement to report your business tax entitlements and obligations, including GST, pay as you go (PAYG) instalments, PAYG withholding and fringe benefit tax instalments. Accounting for GST on a Cash Basis means that for a particular reporting period you include in your activity statement payments received for your sales and the amounts you paid for your purchases. Accounting for GST on a Non-Cash Basis(accrual) means you include in your activity statement the sales for which you issued invoices and the purchases for which your suppliers issued invoices.

Debtors Accrual

• On finalisation of a Debtors Accrual Batch, entries with an appropriate GST tag will be updated to the ledger and included on the GST Return and in the GST Items File.

• Income accounts will be debited and the GST Control Account will be credited with the appropriate GST $ value.

Debtors Cash/Sundries

• On finalisation of a Receipt Batch, entries with an appropriate GST tag will be updated to the ledger and included on the GST Return and in the GST Items File.

• Income accounts will be debited and the GST Control Account will be credited with the appropriate GST $ value

Creditor Invoices

• On finalisation of a Creditor Invoice Batch, entries with an appropriate GST tag will be updated to the ledger and included on the GST Return and in the GST Items File.

• Expense accounts will be credited and the GST Control Account will be debited with the appropriate GST $ value

Bank Deposits,Bank Payments,Bank Transfers

• On finalisation of a either of the above Bankings, entries with an appropriate GST tag will be updated to the ledger and included on the GST Return and in the GST Items File.

• Expense accounts will be credited/debited and the GST Control Account will be debited/credited with the appropriate GST $ value.

General Ledger Manual Journals

• Entries that are entered into the General Ledger via a Manual Journal have no impact on the GST Batch run. These entries must be accounted for manually.

Either way you must keep adequate records of your purchases and sales, including the GST amounts.

CODE | NAME | BAS Code | CODE |

| ADA | Input tax credit adjustments | G18 Input Tax Credit Adjustments | ADA |

| ADS | GST payable adjustments | G7 GST Payable Adjustments | ADS |

| CAP | Capital acquisitions | G10 Captial Acquisitions | CAP |

| EXP | Exports (GST free) | G2 Export Sales (Free) | EXP |

| FCA | GST free Capital acquisitions | G14 GST Free Capital Acquisitions (Purchases Without GST In The Price) | FOA |

| FOA | GST free other acquisitions | G14 GST Free Other Acquisitions (Purchases Without GST In The Price) | FOA |

| FRE | Other GST free supplies | G3 Other GST Free Sales | FRE |

| GST | Goods and services tax | G6 Total Sales (Goods and Services Tax) | GST |

| ICA | Input taxed capital acquisitions | G13 Input Taxed Capital Acquisitions | ICA |

| INP | Other acquisitions | G17 (Total purchases subject to GST) | INP |

| IOA | Input taxed other acquisitions | G13 Input Taxed Other Acquisitions | IOA |

| ITS | Input taxed sales and supplies | G4 Input Taxed Sales and Supplies | ITS |

| LCP | Luxury car tax payable | 1E Luxury Car Tax Payable | LCP |

| LCR | Luxury car tax refundable | 1F Luxury Car Tax efundable | LCR |

| MVA | Motor vehicle acquisitions | G10 MV Capital Acquisistions | MVA |

| NTE | No Tax Effect | None. Using this taxcode on a transaction has no affect on the GST and will not be part of the GST Item or BAS | NTE |

| PCA | Private use capital acquisitions | G15 Estimated Purchases For Private Use or Not Income Tax Deductible | PCA |

| POA | Private use other acquisitions | G15 Estimated Purchases For Private Use or Not Income Tax Deductible | POA |

| WEP | Wine equalisation tax payable | 1C Wine Equalisation Tax Payable | WEP |

| WER | Wine equalisation tax refundable | 1D Wine Equalisation Tax Refundable | WER |

| 10% | Non Capital Purchases | G11 Non Capital Purchases (GST Paid) | 10% |

Reference

Button

Refer to Common Buttons

Fields

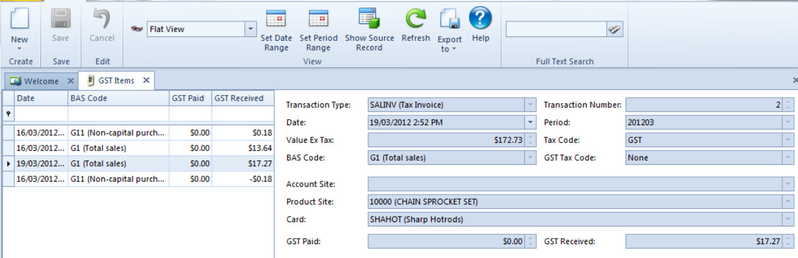

| Field | Description |

|---|---|

| Type | This is the transaction type for this GST Item eg (CBKPAY) |

| Number | This field contains a unique transaction number that identifies the GST Item |

| Site | The site for this GST Item |

| Date | The date and time for the GST item |

| Period | This is the period when this GST item occurred |

| Tax Code | This shows the tax code for the GST item |

| BAS Code | The BAS Code (E.g: G10 Capital Purchases) |

| GST Tax Code | The GST Tax Code |

| Value Ex Tax | This is the value of the GST Item, excluding tax |

| Value INC Tax | This is the value of the GST Item, including tax |

| GST Paid | The GST paid value of the GST item |

| GST Received | The GST received value of the GST item |

| Cash Basis Due | This is the date and time when the payment against a gst item has been allocated for cash basis gst |

| Account Site | This is the account site for the GST item |

| Product Site | This is the product site for this GST item |

| Card | This is the cardid for this GST item |

GST Module

All Transactions entered into Readysell that have any form of a tax code will flow straight into the GST Module into GST Items.

General Ledger Journals do not create a GST Item

Before running your first GST Batch, if you wish to line up your GST Items and have them balance back to the corresponding General Ledger GST Accounts, you will need to provide Readysell with the starting positions for Bas Codes involved.

Readysell will insert these figures behind the scenes.

This process incurs a charge.

Please note, ensure to close off each period accordingly.

DO NOT BACKDATE any transactions into a prior period or quarter.

Ensure when reviewing Gst Items and/or GST Batch (before posting) that you check the taxcodes against the transaction types.

From the Navigational>Financials>Tax>GST Items

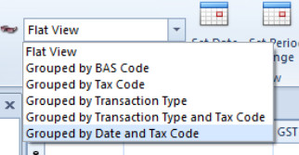

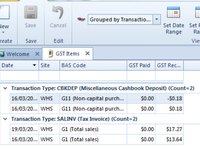

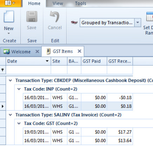

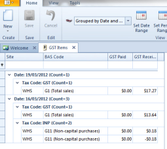

You will see a series of Transactions depending on what view you have selected

- You can change the view to suit yourself.

Select the drop down box and click on one of the selections

Flat view is a list of all open items by date with details to the right of the window of the source transaction

- As you highlight each open item, to see more details of the transaction click on 'Show Source Record' doesnt make what view you have selected. The transaction will appear on another window for you to preview in more detail.

Also available is the ability to 'Export' any transaction highlighted to either XLS, CSV etc by clicking on 'Export to' and making a selection from there.

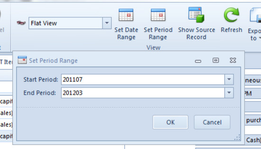

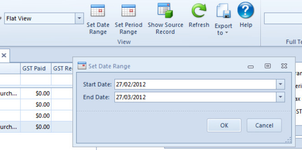

Also available is the ability to narrow your search by setting a 'Date range' or 'Period Range' by clicking on either one of the icons top task bar and entering your criteria.

Screen Prints of Different Views listed below