Entering a Manual Bank Payment

The only entries to be entered through the cashbook as bank payments are those that appear on a Bank Statement that is not supplier-related payments and the bank account is not going to be reconciled and you don't have bank reconciliation rules set up for when importing bank statement.

If you have regular payments coming out of a particular bank account that you do Bank Reconciliation for and you import bank statements, that you don't have a supplier set up for this form of a service, then create a bank reconciliation rule and let the system create the payment for you when importing bank statement lines.

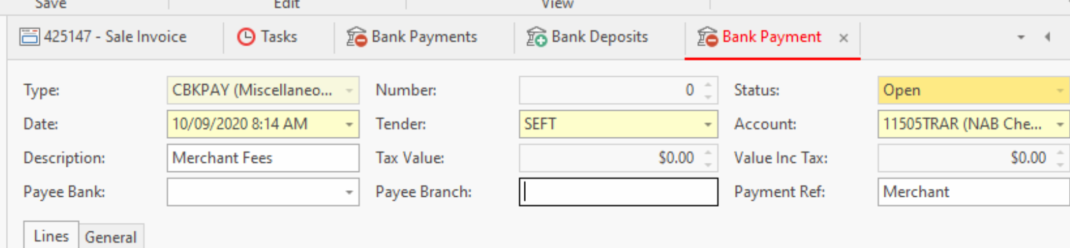

- From the Navigational panel, Financials> Bank Payments

- Click on New to create a new bank payment

- Make sure you enter the date that is on the Bank Statement

- Enter a description to best describe the payment

Enter/select the correct Tender (if the tender is cheque then fill in the cheque details as per print below)

- Select the correct bank account that the payment is being made from

- Enter into the Payment Ref, one word from the bank statement

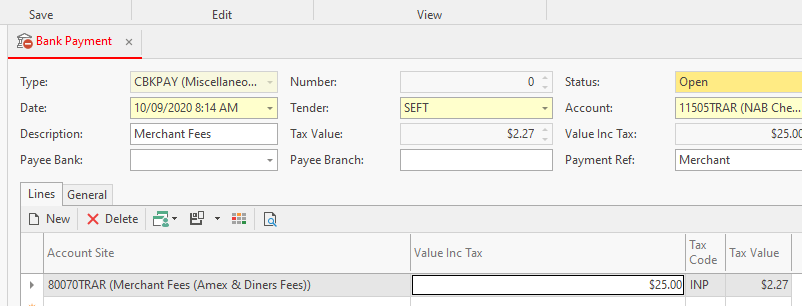

- Navigate down to the Lines Tab

- Search for the correct general ledger account (you may have multiple gl accounts to dissect against)

- Enter another Description if need be or leave the prepopulated one from the header

- Enter the Value Inc Tax of the payment

Select the correct Tax Code (very important)

- Click on either

- Finalise to complete and exit out of the insert payment window, or

Finalise and New to complete this payment and commence another payment.