Overview

Readysell has asked a number of accountants for advice on how to handle supplier rebates. We have received conflicting advice. Some advising us to handle rebates as other income, some advising us to handle rebates as a reduction in cost of goods sold. Readysell can't advise on accounting matters and particularly can't advise on this matter. The procedure below is one way of handling supplier rebates. Please seek advice from your accountant about the procedure you should use. Readysell takes no responsability for the approach below.

What ever approach you use should be consistent:

- If you regard supplier rebates as other income by posting the effect of the supplier rebate the other income account, then the gst code should be GST, as sales have GST. The GST item will increase the GST received

- If you regard supplier rebates as a reduction in cost of goods sold, then the gst code should be INP, (if the goods being rebated had gst on them), as transactions creating the stock used in cost of goods sold, purchase invoices for example, have a gst code of INP. The GSt item will reduce the GST Paid

The amount and timeing of tax you pay the tax office should be the same under both appraoches. The way your BAS report figures are broken up will vary.

Forms of supplier rebate

A supplier rebate can be received in the form of two things:

- Supplier Refund either via a cheque or direct deposit into your bank account

OR - Supplier Credit Note only

Handling of a Supplier Refund if you receive a form of Money - 2 Methods:

Method 1:

Firstly you need to account for the Rebate and secondly the actual Refund of Money Received

If the supplier is set up as a card then follow the steps below:

- Log onto readysell

- Select Relationships

- Select Supplier Transactions

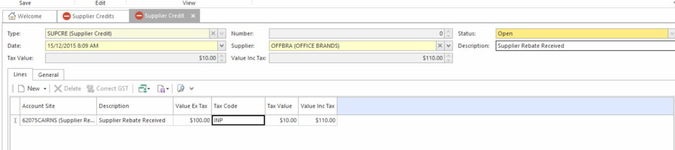

- Select Supplier Credit

- Click on New

- Enter the date that the deposit was made onto the bank statement onto the supplier credit

- Select the Supplier Card

- Enter into the description field something like 'Supplier Rebate Received'

- On the line level select the General Ledger Account to stand for the Supplier Rebate Received

- Either leave the default descrption of change it

- Enter either the Value Inc or Value Ex and the tax code = INP or GST (seeing warning - based upon where in the chart your rebate received general ledger account resides)

If you use a general ledger account that is cost of goods sold your tax code should probably be "INP" as tax relates to a input to your business. If you use an other income account, your tax code should probably be "GST" as tax relates to other sales income you are recoginsing.

- Check the header value lines up to the value of the deposit.

- Click on Finalise

Now to account for either the Deposit received or cheque received onto the supplier account.

Log onto readysell

Select Relationships

Select Supplier Transactions

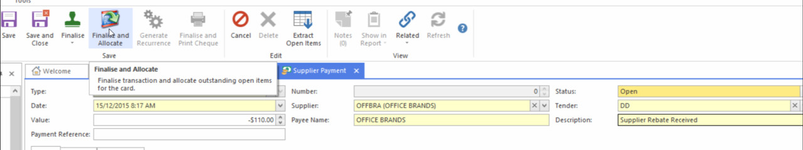

Select Supplier Payments

Click on New

Enter the date that the deposit was made onto the bank statement onto the supplier payment

Select the Supplier Card

Enter into the description field a reference off the 'supplier rebate received' and maybe the cheque no

- Into the Payment Reference field, enter something off the Bank Statement or the cheque number

Enter the value in BACKWARDS with a MINUS Sign in front of it EG $-110 (as the supplier if depositing money into your account)

Click on Finalise and Allocate

Allocate the backwards supplier payment against the orgiinal supplier credit. Finalise and allocate button

Method 2:

If you dont have a supplier set up and you have received the rebate in the form of money being either a direct deposit or a physical cheque follow steps below:

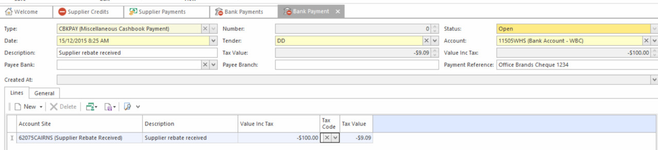

Entering a bank Payment backwards to stand for the supplier rebate received

Log onto readysell

Select Financials

- Select Cashbook

Select Bank Payments or Bank Deposit ( based upon where in the chart your rebate received general ledger account resides)

Click on New

Enter the date that the deposit appears on the bank statement

- Select the correct tender

- Select the bank account that the deposit is being made into

Enter into the description field a reference off the 'supplier rebate received' and or if you have a maybe the cheque no

- Into the Payment Reference field, enter something off the Bank Statement or if a cheque was received the cheque number

On the level level , select the General Ledger account for 'Supplier Rebate Received' and Enter the value in BACKWARDS with a MINUS Sign in front of it EG $-100 (as the supplier is depositing money into your account)

Click on Finalise.

Handling a Supplier Rebate if you only receive a Credit Note:

- Log onto readysell

- Select Relationships

- Select Supplier Transactions

- Select Supplier Credit

- Click on New

- Enter the date that that appears on the Credit Note

- Select the Supplier Card

- Enter into the description field something like 'Supplier Rebate Received and the Credit note Number'

- On the line level select the General Ledger Account to stand for the Supplier Rebate Received

- Either leave the default descrption of change it

- Enter either the Value Inc or Value Ex and the tax code = INP or GST (seeing warning -based upon where in the chart your rebate received general ledger account resides)

- Check the header value lines up to the value of the deposit.

- Click on Finalise