A supplier rebate can be received in the form of two things:

- Supplier Refund either via a cheque or direct deposit into your bank account

OR - Supplier Credit Note only

Handling of a Supplier Refund if you receive a form of Money - 2 Methods:

Method 1:

Firstly you need to account for the Rebate and secondly the actual Refund of Money Received

If the supplier is set up as a card then follow the steps below:

- Log onto readysell

- Select Relationships

- Select Supplier Transactions

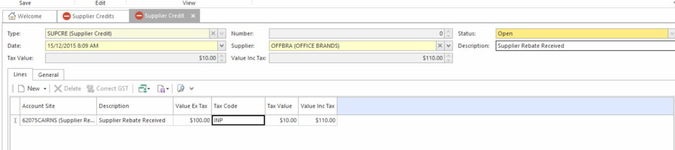

- Select Supplier Credit

- Click on New

- Enter the date that the deposit was made onto the bank statement onto the supplier credit

- Select the Supplier Card

- Enter into the description field something like 'Supplier Rebate Received'

- On the line level select the General Ledger Account to stand for the Supplier Rebate Received

- Either leave the default descrption of change it

- Enter either the Value Inc or Value Ex and the tax code = INP

- Check the header value lines up to the value of the deposit.

- Click on Finalise

Now to account for either the Deposit received or cheque received onto the supplier account.

Log onto readysell

Select Relationships

Select Supplier Transactions

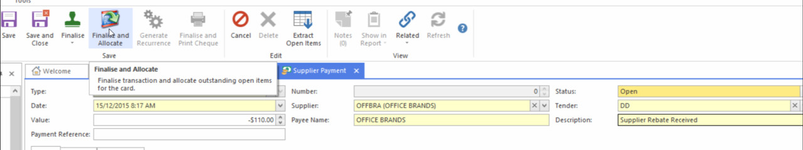

Select Supplier Payments

Click on New

Enter the date that the deposit was made onto the bank statement onto the supplier payment

Select the Supplier Card

Enter into the description field a reference off the 'supplier rebate received' and maybe the cheque no

- Into the Payment Reference field, enter something off the Bank Statement or the cheque number

Enter the value in BACKWARDS with a MINUS Sign in front of it EG $-110 (as the supplier if depositing money into your account)

Click on Finalise and Allocate

Allocate the backwards supplier payment against the orgiinal supplier credit. Finalise and allocate button

Method 2:

If you dont have a supplier set up and you have received the rebate in the form of money being either a direct deposit or a physical cheque follow steps below:

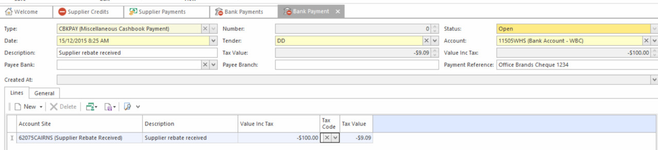

Entering a bank Payment backwards to stand for the supplier rebate received

Log onto readysell

Select Financials

- Select Cashbook

Select Bank Payments

Click on New

Enter the date that the deposit appears on the bank statement

- Select the correct tender

- Select the bank account that the deposit is being made into

Enter into the description field a reference off the 'supplier rebate received' and or if you have a maybe the cheque no

- Into the Payment Reference field, enter something off the Bank Statement or if a cheque was received the cheque number

On the level level , select the General Ledger account for 'Supplier Rebate Received' and Enter the value in BACKWARDS with a MINUS Sign in front of it EG $-100 (as the supplier is depositing money into your account)

Click on Finalise.

Handling a Supplier Rebate if you only receive a Credit Note:

- Log onto readysell

- Select Relationships

- Select Supplier Transactions

- Select Supplier Credit

- Click on New

- Enter the date that that appears on the Credit Note

- Select the Supplier Card

- Enter into the description field something like 'Supplier Rebate Received and the Credit note Number'

- On the line level select the General Ledger Account to stand for the Supplier Rebate Received

- Either leave the default descrption of change it

- Enter either the Value Inc or Value Ex and the tax code = INP

- Check the header value lines up to the value of the deposit.

- Click on Finalise