Tax codes are used in the product file, during sales, purchasing and purchase receipting. Tax codes are also used for GST and reporting purposes.

- From the Navigation panel

- Double click on "Administration"

- Click on "Tax Codes"

- The Tax Codes browse window opens

- The browse shows you each available tax code that can be used through the Readysell system.

- As you click on each tax code (left hand side) the details will display on the right hand side of the browse.

- Click on button New

- The Tax Code entry window opens

- Key in the Code for the Tax Code

- Key in the Value that the Tax Code represents

- Key in the actual Name for the Tax Code

- Turn the the flag on or off according to whether the Tax Code is Available For Product

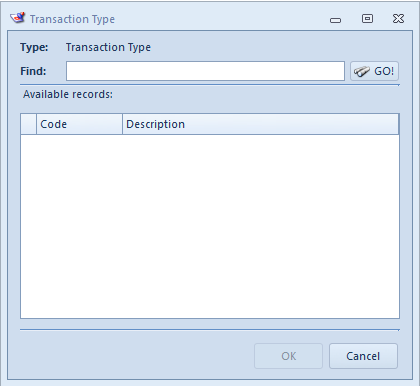

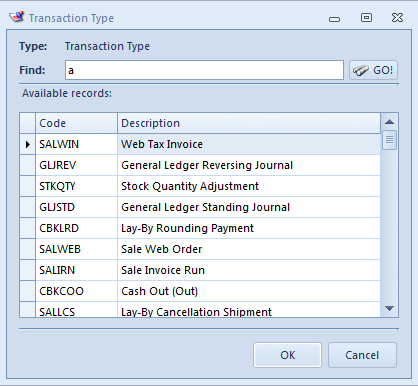

- Transaction Type search/selection window opens

- Key in the type of transaction type or part of the transaction type to bring up the list

- Left click on the transaction type and click on OK

- Transaction Type search/selection window opens

- The transaction type is added to the Available For Transaction Types window

- The Tax Code entry window opens

- Click on button Save and Close to save this and close out of the window