Overview

A sales invoice represents the financial charge to a customer for one or many shipments. A single sales invoice can cover a single shipment, a group of shipments related to the same sale order, or all shipments to a single customer in a single month.

...

| Image | Field | Description | ||

|---|---|---|---|---|

| Reverse | Reverses the invoice but not the shipment. The shipment will need to be dealt with accordingly (either reinvoiced or reversed etc). | |||

| Credit | This is used to raise a credit from an invoice trying to credit all lines on the invoice. It will create a sale shipment with all lines from the original invoice allowing you to make any changes, add reasons for credit and remove off lines you do not wish to credit.

| |||

| Pay | This will generate a customer payment that is linked directly to the invoice. If you finalise that payment, it will be allocated directly to the invoice. | |||

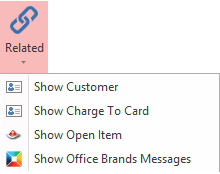

| Related | Allows you to

|

...

| Field | Description |

|---|---|

| Type | This is the transaction type for this Invoice (SALINV / SALCRD / etc) |

| Number | This field contains a unique Readysell transaction number that identifies the sale invoice/credit |

| Status | The transactions current status which can have optional colour coding of the status property on all transactions |

| Date | The date and time of this transaction. Defaults to the date/time this transaction was created |

| Customer | This is the customer that this invoiced relates to |

| Customer Order | This field shows the customer order for this sales invoice customer can enter a unique value. This field is also editable once invoiced this can only be set through a system reference in SALES> INVOICE-CUSTOMER-ORDER-EDIT-DAYS: Set the days after posting that the customer order of the sale invoice can be edited |

| Value | This is the total value inc tax invoiced for the sale invoice. This value is automatically calculated |

| Tax Value | This is the total tax applied to the sale invoice. This value is automatically calculated |

| Document Group | You can group customers into certain document group ranges. (Example only: schools can all have document numbers starting at 1000000 and normal customers are in the 3000000 range and govt customers are all in the 9000000 range.) |

| Change | The change given to the customer for this invoice if paid by cash |

| Year | This shows the year the Invoice was created |

| Month | This is the month the Invoice was created e.g if its February it will show a 2 |

| Week Of Year | This is an integer which counts how many weeks have passed since the first week of the year. e.g of invoice is created 8/2/2017 this is in week 6 of the year |

Lines tab

| Field | Description |

|---|---|

| Product | The product/s on the lines of the sale invoice |

| Product Name | The product name on the lines of the sale invoice |

| Qty Invoiced | This field shows the unit quantity invoiced on the lines of the sale invoice |

| Unit | The product unit for the line/s |

| Unit Quantity on Hand | The products quantity on hand |

| Price Inc Tax | The unit price including tax for the line/s |

Discount Percent | The discount applied to the item per line, expressed as a percentage |

| Tax Code | The tax Code for the product/s on the lines of the sale invoice |

| Tax Value | The total tax value invoiced for each line of product. The value is automatically calculated |

| Value Inc Tax Invoiced | This is the total value inc taxed invoiced for for each line of product |

| Note | Check Box - This indicates if the product line has a note attached to it (tick box). If ticked, you can look at tab Line Notes to see the note. |

| Variance Percent To Default Price Level | Show percentage difference between the invoice and price value for each line of product |

| Value Inc Tax At Default Price Level | Product Value Inc Tax for the Default Price Level |

| Value Ex Tax At Default Price Level | Product Value Ex Tax for the Default Price Level |

...