Overview

A sales invoice represents the financial charge to a customer for one or many shipments. A single sales invoice can cover a single shipment, a group of shipments related to the same sale order, or all shipments to a single customer in a single month.

...

Refer to Common Buttons.

| Image | Field | Description | ||

|---|---|---|---|---|

| Reverse | Reverses the invoice but not the shipment. The shipment will need to be dealt with accordingly (either reinvoiced or reversed etc). | |||

| Credit | This is used to raise a credit from an invoice trying to credit all lines on the invoice. It will create a sale shipment with all lines from the original invoice allowing you to make any changes, add reasons for credit and remove off lines you do not wish to credit.

| |||

| Pay | This will generate a customer payment that is linked directly to the invoice. If you finalise that payment, it will be allocated directly to the invoice. | |||

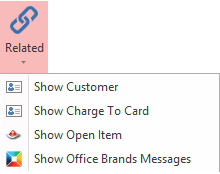

| Related | Allows you to

|

...

|

Fields

| Field | Description |

|---|---|

| Type | This is the transaction type for this Invoice (SALINV / SALCRD / etc) |

| Number | This field contains a unique Readysell transaction number that identifies the sale invoice/credit |

| Status | The transactions current status which can have optional colour coding of the status property on all transactions |

| Date | The date and time of this transaction. Defaults to the date/time this transaction was created |

| Customer | This is the customer that this invoiced relates to |

| Customer Order | This field shows the customer order for this sales invoice customer can enter a unique value. This field is also editable once invoiced this can only be set through a system reference in SALES> INVOICE-CUSTOMER-ORDER-EDIT-DAYS: Set the days after posting that the customer order of the sale invoice can be edited |

| Value | This is the total value inc tax invoiced for the sale invoice. This value is automatically calculated |

| Tax Value | This is the total tax applied to the sale invoice. This value is automatically calculated |

| Document Group | You can group customers into certain document group ranges. (Example only: schools can all have document numbers starting at 1000000 and normal customers are in the 3000000 range and govt customers are all in the 9000000 range.) |

| Change | The change given to the customer for this invoice if paid by cash |

| Year | This shows the year the Invoice was created |

| Month | This is the month the Invoice was created e.g if its February it will show a 2 |

| Week Of Year | This is an integer which counts how many weeks have passed since the first week of the year. e.g of invoice is created 8/2/2017 this is in week 6 of the year |

Lines tab

| Field | Description |

|---|---|

| Product | The product/s on the lines of the sale invoice |

| Product Name | The product name/s name on the lines of the sale invoice |

| Qty Invoiced | This field shows the unit quantity invoiced on the lines of the sale invoice |

| Unit | The product unit for the line/s |

| Unit Quantity on Hand | The products quantity on hand |

| Price Inc Tax | The unit price including tax for the line/s |

Discount Percent | The discount applied to the item per line, expressed as a percentage |

| Tax Code | The tax Code for the product/s on the lines of the sale invoice |

| Tax Value | The total tax value invoiced for each line of product. The value is automatically calculated |

| Value Inc Tax Invoiced | This is the total value inc taxed invoiced for for each line of product |

| NotesNote | Check Box - This indicates if the product line has a note attached to it (tick box). If ticked, you can look at tab Line Notes to see the note. |

| Variance Percent To Default Price Level | Show percentage difference between the invoice and price value for each line of product |

| Value Inc Tax At Default Price Level | Product Value Inc Tax for the Default Price Level |

| Value Ex Tax At Default Price Level | Product Value Ex Tax for the Default Price Level |

...

| Field | Description |

|---|---|

| Each Cost Ex Tax | The cost of each item, Excluding Tax |

| Unit Cost Ex Tax | The unit cost excluding tax for the linethe product |

| Price Ex Tax | The price ex tax of the product |

| Tax Code | The tax code for the line |

| Unit QOH | The products quantity on hand |

| Points Gained | Loyalty Points Gained |

| Warranty | The warranty for the line |

| Warranty Expiry | The expiry date for the warranty |

Line Notes tab

| Field | Description |

|---|---|

| blank text field | Provided you have entered a note an order or shipment, you can key in any related note, colour the font, highlight the font, make is larger/smaller, etc. This will then print on the invoice. |

Internal Notes tab

| Field | Description |

|---|---|

| blank text field | Provided you have entered an internal note an order or shipment, you can key in any related note, colour the font, highlight the font, make is larger/smaller, etc. This will only print on the shipment and NOT for customer . |

Dissections

| Field | Description |

|---|---|

| Account SIte | This is the Account SIte for the dissection |

| Debit Value | This is the debit value of the dissection |

| Credit Value | This field shows the credit value for this dissection |

| Narrative | The narrative for the dissection |

| Description | This field contains a description of the dissection |

...

| Field | Description |

|---|---|

| Site | Site Code as to where the transaction is entered for |

| Period | The current period the transaction is entered for |

| Created By | Is the The user who created the Transaction in question (comes from the operator code or if one was entered. If not it will use the User who logged into Readysell to begin with) |

| Payment Term | The Customer's payment terms on this invoice - can come from either the customer's card or the payment terms on the sales order |

| Date Due | The date as to which the payment is due for this invoice based on the customer's payment terms |

| Ref number | The Reference Number for the Sale Invoice (would have been entered at the time the sales order or sale shipment was created) |

| Value Ex Tax | This is the The Value Ex tax Invoiced for the sale Invoice |

| Discount Value | The total value of any discounts applied to Invoiced stock |

| Margin | This is the The margin dollar value for the sales Invoice |

| GP % | The Gross profit for the sale invoice, expressed as a percentage |

| Margin % | This is the margin % for the sales invoice |

| Charge To | Charge to comes from the card details. It automatically fills in based on what is set up on the customer card. |

| Points Gained | Loyalty Points Gained in total from this invoice |

| Hour | This shows the postedat property of transactions as an hour of the day in 24 hour clock format. Its used if the user wants to make an analysis report based on day of week and hour of day to determine staffing requirements. |

| Entered By | - The user who created the associated sale order (if any) - Otherwise, the user who created the associated sale shipment (if any) - Otherwise, the user who posted the invoice (if posted) - Otherwise, the user who created the invoice |

...

The related message for the invoice if it was emailed to the customer

| Field | Description |

|---|---|

Date | The date the emailed copy of the invoice was sent |

| To | Email address of who the invoice was sent to |

| Subject | Subject line of the email of who the invoice was sent to |

...