Receipting and invoicing ordered goods using a purchase receipt

When receiving and invoicing goods, you have an invoice or delivery docket that has your original purchase order number on it. Therefore the logical place to start is the Purchase Orders module.

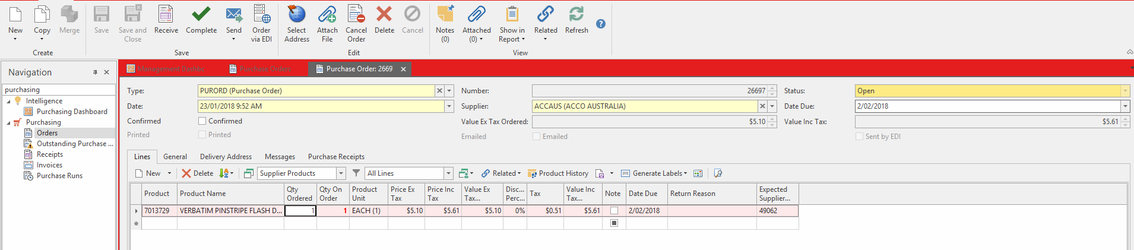

- From the Navigation panel, open up Purchasing, click on Orders

- Search for and select the purchase order you want to receive.

Click on the Receive button to create a new purchase receipt for the order

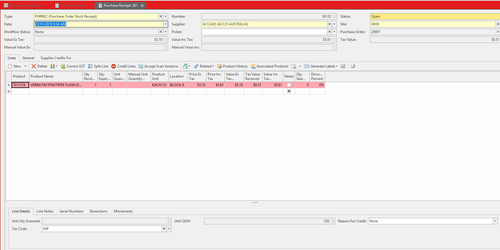

Make sure that the Date on the Purchase Receipt window matches EXACTLY the date that the stock came into your site. (This date is NOT the date on the invoice)

For those stores running auto stock adjustments, this date is very important as it affects your stock levels and may throw your stock out.

Review the purchase receipt, checking off products, quantities, cost pricing, Value Inc Tax field must match the invoice value exactly from the supplier.

If you are out by any value, you must go back and check the lines.Readysell always recommends using the Value Inc Tax field or Value Ex Tax field when updating the cost pricing on your receipt.

The reason being that your supplier, like you, uses pricing to 4 decimal places. When they invoice, it rounds it to 2 decimal places. If you work with the total inc or total ex or extension then most likely your totals will line up with your supplier's invoice. If you work with the individual pricing then you will most likely strike more problems lining up the suppliers invoice to your totals.

The Value Ex Tax, the Value Inc Tax and the Tax Value (GST) in Readysell must all line up exactly to your supplier's invoice.

You can use the Correct GST button to correct the GST on a line with or without affecting the total value of the line.

- If your total on the invoice is out by 1 cent, either decrease or increase the Tax Value accordingly in the Correct GST Rounding Error window by 1 cent only. Turn off the flag for Update Value Inc Tax. (if you leave this flagged, the total value on the line and the total on the header will be affected as well.Use the Rounding product only if you are out by a few cents and all other lines match the invoice exactly. If it is a larger dollar value amount, please create a support ticket for this for further assistance.

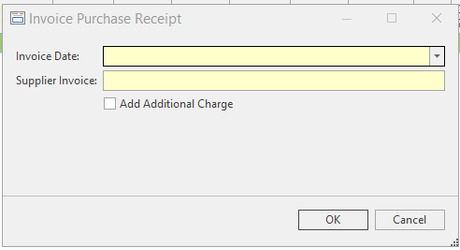

- Click on button Complete

- Key in the Supplier's Invoice number.

If necessary, adjust the date.

The Invoice Date on the Complete Purchase window that goes in the Supplier Invoice field must match exactly the date on the invoice the supplier sent you.

Click on button OK to complete the receipt.

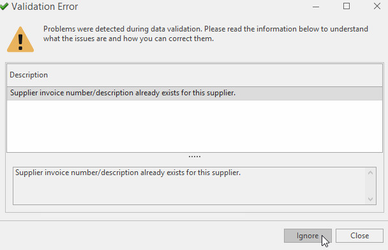

You can choose to ignore the purchase invoice is not unique validation

Should you get this, please check with your Purchase Invoice window before proceeding further if you are not sure if this has already been received from a duplicate purchase order.

If you are running a multi-location warehouse:

- Check free locations and enter the correct location on the receipt line.

- If the stock is going into multiple locations, use the Split button on the receipt to split the line into multiple locations.

- Use Show in Report to print a purchase receival check report to show you the correct locations to put the goods.

Partially receiving a purchase order

- Open the purchase order you want to receive.

- Click on the button Receive.

Review the purchase receipt, checking off products, quantities, and cost pricing, Value Inc Tax field matches the invoice value from the supplier.

If quantity value is updated Readysell notes the quantity still outstanding for the purchase order.

- Click on the button Complete

- Key in the Supplier Invoice number.

- If necessary, adjust the date.

Click on the button OK to complete the receipt.

You can see the quantity of stock outstanding by clicking Receive again in the Purchase Order screen.

If the Supplier has only supplied some of the items:

On the Purchase Receipt (NOT THE PURCHASE ORDER), either zero off the Qty Received or delete that line of product off completely. If the item is part supplied, then change the qty received to what it shows on the invoice/delivery note

Where the supplier is no longer supplying some of the items on the purchase order:

For any lines on the purchase order that will not be supplied at all by the supplier, change the Qty Ordered to be 0. If it is already partly received, then change the Qty Ordered to be the amount you have already received.