Tax codes are used in the product file, during sales, purchasing and purchase receipting. Tax codes are also used for GST and reporting purposes.

From the Navigation panel

- Double click on "Administration"

Click on "Tax Codes"

Expand title Show me , click on 'Administration' then click on 'Tax Codes'

The Tax Codes browse window opens

Expand title Show me - The browse shows you each available tax code that can be used through the Readysell system.

- As you click on each tax code (left hand side) the details will display on the right hand side of the browse.

- Click on button New

The Tax Code entry window opens

Expand title Show me - Key in the Code for the Tax Code

- Key in the Value that the Tax Code represents

- Key in the actual Name for the Tax Code

- Turn the the flag on or off according to whether the Tax Code is Available For Product

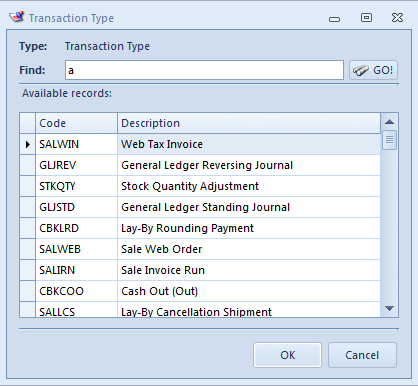

Transaction Type search/selection window opens

Expand title Show me Key in the type of transaction type or part of the transaction type to bring up the list

Expand title Show me Left click on the transaction type and click on OK

Expand title Show me

- The transaction type is added to the Available For Transaction Types window

- Click on button Save and Close to save this and close out of the window