...

| Note |

|---|

Please ensure to contact Readysell - before you commence with the set up of Keypay Four steps needs to be completed before you can commence with Keypay: 1. Sign up for the Trial version Keypay which is part of the white label by clicking on the link https://readysell.com.au/product/payroll/ |

| Info |

|---|

Questions that may arise from being unable to import the key pay journal into Readysell. If your question/s are about a problem you’re having, please help us diagnose the API issue by providing them with:

- JSON Request that you are sending - JSON Response/message that you are receiving

API key from within either Readysell>system type>Payroll>API or get the API from keypay under My Accounts |

| Note |

|---|

If you wish to break up expenses and liabilities further you need to ensure that the general ledger accounts have been set up in Readysell firstly before you continue with Advanced Configurations. Refer link Creating/ Modifying a general ledger account |

...

- Log onto Readysell>Payroll

- Log in using your payroll username and password (sites) wait for verification code

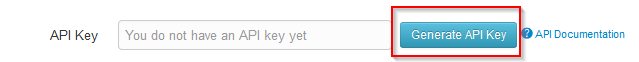

At the top right, Obtaining your API Key

To obtain your API key, log into KeyPay and click your name in the top right corner, then click My Account

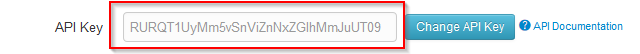

Copy the "API Key" to your clipboard.

Click Generate API Key and a key will be generated for you.

Your key will now be generated. Double click the text and copy it. Store this key somewhere safe. Please note that clicking Change API Key will invalidate your old API key.

- Log into Readysell to set your API Key

- Navigate to Administration > Advanced > System Types>PAYROLL

Paste the API Key from your clipboard into the Value field of the "KEYPAY-API-KEY" system reference and click on Save

Expand title Show me Click on Save

- Switch back to the Dashboard/Company name

On the top URL bar you will see https://readysell.yourpayroll.com.au/business/111111/businessdetails (EG)

Note the number at the end of the Address (URL)PasteGo back into Readysell and paste this number into the VALUE field in Readysell>Administration > Advanced > System Types>PAYROLL>keypay-business-id

Expand title Show me Business ID Click on Save

- If you have tweaked your Readysell chart of accounts (that is changed the accountid within the chart), modify the account IDs as necessary in the system reference to reflect your accountid from the chart and leave the system reference for 'use-keypay-journal' with a value = False

- Click Save

...

KeyPay has the ability to pay employee super contributions directly to any registered super fund in Australia by integrating with the ClickSuper super the Beam super fund clearing house (https://beamconnect.com.au).

Automated super payments are available for all users and quarterly super processing is included at no additional cost.If you wish to process super at more regular intervals, there is an additional 25c per employee per batch submission.

To register for ClickSuperBeam:

- log into your business in KeyPay, click the Business menu, then Super Payments

| Expand |

|---|

- Click the ‘Register for ClickSuper’ Beam’ button on the page

| Expand |

|---|

- Read the PDS on the ClickSuper Beam registration page, accept the terms and conditions and click “Submit”

- Complete the registration details on the registration page and click “submit”

Once you’ve registered you can make automated super payments by following following these instructions.

If you would like any more information on automated super payments within KeyPay, please contact us via support@yourpayroll.com.au