...

| Note |

|---|

Please ensure to contact Readysell - Greg Payne before you commence with the set up of Keypay Four steps needs to be completed before you can commence with Keypay: 1. Sign up for the Keypay which is part of the white label by clicking on the link https://readysell.com.au/product/payroll/ |

| Info |

|---|

Questions that may arise from being unable to import the key pay journal into Readysell. If your question/s are about a problem you’re having, please help us diagnose the API issue by providing them with:

- JSON Request that you are sending - JSON Response/message that you are receiving

API key from within either Readysell>system type>Payroll>API or get the API from keypay under My Accounts |

| Note |

|---|

If you wish to break up expenses and liabilities further you need to ensure that the general ledger accounts have been set up in Readysell firstly before you continue with Advanced Configurations. Refer link Creating/ Modifying a general ledger account |

...

Readysell Payroll is powered by KeyPay, an online payroll system designed to make payroll simpler for small to medium businesses.

KeyPay is quick to set up, intuitive and easy to use and integrated into your Readysell system.

You can learn more about the features of Readysell Payroll at our web site. https://readysell.com.au/product/payroll/

You need to sign up first by clicking on the link above and taking it from there.

Before you can use the payroll import feature, you must ensure that you've set up the integration in Readysell. Follow these steps to set up Readysell appropriately.

Payroll

So far every dealer has been able to setup keypay without any help from Readysell, just using the documentation. But you can always book a few hours of assistance from our implementation team if you want us to do the setup work for you.

Procedure

Standard configuration

API Key & Business ID setup

This is the recommended configuration for most Readysell customers. Payroll data is automatically mapped to Readysell general ledger accounts based on pre-defined rules.

- In Readysell, navigate to Log onto Readysell>Payroll

- Log in using your payroll username and password At the top right, (sites) wait for verification code

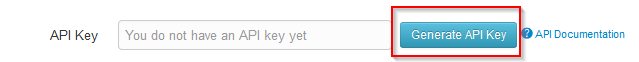

Obtaining your API Key

To obtain your API key, log into KeyPay and click your name in the top right corner, then click My Account

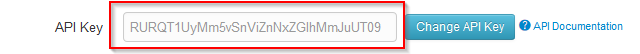

Copy the "API Key" to your clipboard.

Click Generate API Key and a key will be generated for you.

Your key will now be generated. Double click the text and copy it. Store this key somewhere safe. Please note that clicking Change API Key will invalidate your old API key.

- Log into Readysell to set your API Key

- Navigate to Administration > Advanced > System TypesSelect the "PAYROLL" system typeTypes>PAYROLL

Paste the API Key from your clipboard into the Value field of the "KEYPAY-API-KEY" system reference and click on Save

Expand title Show me Click on Save

- Switch back to the Payroll tab

Under Related Businesses right click your business' name and click Properties

Dashboard/Company nameExpand title Show me On the top URL bar you will see https://readysell.yourpayroll.com.au/business/111111/businessdetails (EG)

Note the number at the end of the Address (URL)- Click Cancel

- Switch back to the System Types tab within Readysell

Enter the number you noted into the Value field of the "KEYPAY-BUSINESS-ID" system reference and click on SaveGo back into Readysell and paste this number into the VALUE field in Readysell>Administration > Advanced > System Types>PAYROLL>keypay-business-id

Expand title Show me Business ID Click on Save

- If you have tweaked your Readysell chart of accounts (that is changed the accountid within the chart), modify the account IDs as necessary in the system reference to reflect your accountid from the chart and leave the system reference for 'use-keypay-journal' with a value = False

- Click Save

...

- In Readysell, navigate to Payroll

- Log in using your payroll username and password

- At the top right, click your name, then My Account

- Copy the "API Key" to your clipboard

- Navigate to Administration > Advanced > System Types

- Select the "PAYROLL" system type

- Paste the API Key from your clipboard into the value field of the "KEYPAY-API-KEY" system reference

- Set the value field of the "USE-KEYPAY-JOURNAL" system reference to "True"

- Switch back to the Payroll tab

- Under Related Businesses right click your business' name and click Properties

- Note the number at the end of the Address (URL)

- Click Cancel

- Switch back to the System Types tab

- Enter the number you noted into the value field of the "KEYPAY-BUSINESS-ID" system reference

- Click Save

- Create any general ledger accounts you require to facilitate your payroll configuration (see Creating/ Modifying a general ledger account)

- Switch back to the Payroll tab

- Click Business > Select Company Name

- Click Business >Payroll Settings

- Under Business Settings click Chart Of Accounts

Expand title Show Me - Click On Manage Accounts and start inserting the general ledger accounts breakup for each pay category

Start Adding the First GL Account, Description, Type of Account for each Pay Category you are breaking up. Eg below

Expand title Show me - Add each of the relevant accounts to the list eg Bank, Payg Liability, Payg Expense, Super Liability and Expense, Salary Sacrifice (if you use it), Car allowances if you use it etc.

- Click Back to Chart of Accounts

- Expand Default Accounts, Pay Categories, Deduction Categories and Expense Categories and add any appropriate categories (see Mapping GL accounts)

- Click Save on each

Once the Categories have been set up, if you wish to see the categories against a different general ledger account, you need to go to each category and apply the specific general ledger account. - Go back to Readysell as when you import the keypay journal into Readysell, you will need to use the general ledger accounts on the journal.

Click on System Types in Administration

Type = Payroll

Code = use-keypay-journal

Set this to be True

Click on Save

ABA File Setup

- Log onto Keypay

Select Payroll settings - Select Payment file

Add your aba file settings

Click on Save - Next click on ATO Settings from within Payroll settings

Insert your ATO Supplier settings

Click on Save

| Expand | ||

|---|---|---|

| ||

Registering for Automated Super Payments

KeyPay has the ability to pay employee super contributions directly to any registered super fund in Australia by integrating with the Beam super fund clearing house (https://beamconnect.com.au).

Automated super payments are available for all users and quarterly super processing is included at no additional cost.If you wish to process super at more regular intervals, there is an additional 25c per employee per batch submission.

To register for Beam:

- log into your business in KeyPay, click the Business menu, then Super Payments

| Expand |

|---|

- Click the ‘Register for Beam’ button on the page

| Expand |

|---|

- Read the PDS on the Beam registration page, accept the terms and conditions and click “Submit”

- Complete the registration details on the registration page and click “submit”

Once you’ve registered you can make automated super payments by following these instructions.

If you would like any more information on automated super payments within KeyPay, please contact us via support@yourpayroll.com.au