...

- From the Navigation panel, click on Purchasing then click on Orders

- The credit you get from your supplier will have on it your original supplier credit request number (the STKCRD)

- Search for and select this supplier credit request.

- Click on tab Purchase Receipts

- Select the receipt you are claiming on and click on button Show Transaction

- Click on button Invoice to create an invoice for this receipt

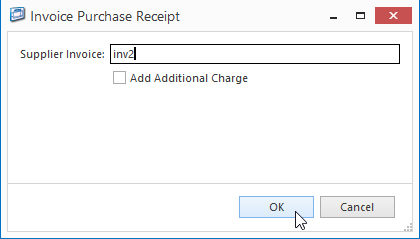

Key in the Supplier's invoice/credit/adjustment note number and click on button OK

Expand title Show me Check that the date of your invoice window matches the date on the credit from the supplier. If it does not, change it to match the same date as the credit from your supplier.

The purchase invoice tab appears and opens a new PURCRD (Purchase Credit)

Check all values (inc gst, ex gst and tax value) to make sure that they all line up to the credit from your supplier

Click on button Default Total to let the system check that all changes are calculated and checked

Click on button Finalise to post the transaction

Expand title Show me

| Info | |||||

|---|---|---|---|---|---|

Observe that the workflow automatically posts the STKCRD (Supplier Credit Request) transaction with the corresponding receipts details showing

|

...