Overview

Product Category is one area within Readysell whereby you can assign a different general ledger account if you wish to use department breakup eg Sales Revenue Admin, Sales Revenue Stationary etc.

You would firstly create the general ledger chart of account for each department and then assign these accounts to the appropriate product category levels.

You may also want to break up the cost of goods area by the same department.

...

| Info |

|---|

General Ledger Account breakups within the product category:

Therefore this means the two accounts should be different if the product is being tracked for stock purposes as opposed to non stock purposes. Cost of Goods Sold: should be a profit & loss account Sold Stock: should be a stock on hand account Purchased Stock should be the same as Sold Stock for stock controlled products, to avoid a discrepancy between recording the purchase (increase in stock) and recording the sale (decrease in stock) unless the product is a non stock product and a type of service or expense. EG Freight Inwards, the purchase general ledger account would be the general ledger account for Freight Inwards. Procedure in respect to creating sub department chart of accounts Highlight the main general ledger account eg Sales Revenue 61010 Repeat steps by highlight the sub department gl account 61010FUR and name it eg 61010ADMIN with a description of Sales Revenue - Administration etc Continue until you have created the appropriate sub departments in the areas of the chart required. Task may need to be run to refresh general ledger balances and/or redissect if you have created new gl accounts and assigned them to categories Speak to Readysell |

...

| Tip | |||||

|---|---|---|---|---|---|

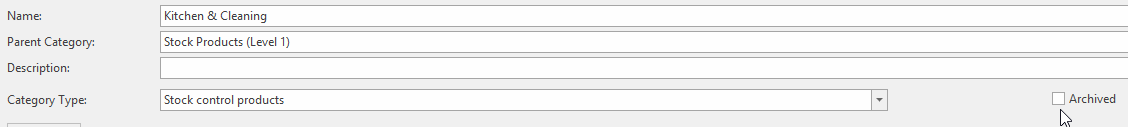

No longer used Product Category can be archived.

|

Non-Stock Product Categories

If a product is not Purchased and not Sold and is any form of a 'Service' then you would assign that product to the correct Non-Stock Product Category.

You can break up your non-stock product categories depending upon the service provided eg Freight Inwards, Restocking Fee, Laminating, Meter charge service, Leasing Fees etc.

You can also set up a separate General Ledger Account if need be and assign to the non-stock product category child.

Readysell has a set of default non-stock product categories already set up. You can add more/maintain these non-stock product categories which will, in turn, give you a breakdown by product category on your Sales Analaysis Analysis Reports.

Managing product costs for non-stock product categories

Product categories can be used to assign a cost when you SELL non-stock products. The methods apply to all products in the non-stock category.

If there is a cost on the non-stock product, then set the cost method on the Product category to be a type = NONE.

If there is a cost on the product and the 'Non-Stock Costing Method' is set to anything else other than NONE, then the cost method on the category will apply.

...

- None, sell at zero cost

- Manual entry, stop and require the user to enter a cost as the product is sold. Need to ensure that the products that you wish to apply a manual cost entry to are in the right product category that has the Non-Stock Costing Method set to Manual Entry.

- Set the cost to be a percentage of the value ex and set the Sale Vale Ex Tax Percent to be the percentage. Eg if you wish to see a GP% of 0 on the Sale set the sale value ex tax percent to be 100%

- Set the cost to be the primary product suppliers cost (cost price 1 mapped for any unit difference between the buy and sell units being used).

If you set a non-stock product category to have a costing method of 'primary product suppliers', ensure that all products within this product category have a primary supplier with a costp1 price.

...