Overview

A bank reconciliation is a process that explains the difference between the bank balance shown in an organisation's bank statement (as supplied by the bank) and the corresponding amount shown in the organisation's own accounting records at a particular point in time. If your account records does not agree with the bank statement, you must determine where the discrepancy is and make the appropriate corrections. It is normal for a company's bank balance to differ from the balance as per bank statement due to timing differences. Such timing differences appear as reconciling items in the bank reconciliation.

Bank reconciliations should be done by date consecutively and periodically. Please ensure that the last bank reconciliation for a financial year is the last day of June - the system will not allow you to extract into the next month. You cannot commence a new bank reconciliation until your current bank reconciliation is balanced and finalised for the bank account you are reconciling.

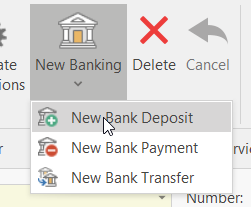

If you do not have any transactions on the last day of the year, create a bankrec for the 30th of June for each bank account and insert a $0.00 deposit from within the bankrec itself by clicking on New, New Bank Deposit. Present it and finalise the bankrec for the last day of the financial year. Then start another bankrec for the beginning of the next month that stands for the first period of the next financial year

The first bank reconciliation must represent the closing bank reconciliation from your old system and must balance back to your general ledger bank account. For the first bank reconciliation, the site will need to provide Readysell with the statement opening date and statement opening balance figure. Readysell will insert this for you as the starting bank reconciliation.

Bank reconciliations are set to compress depending upon what rules have been set up against each tender (usually set up by Readysell at commencement of business). As well as making it easier to navigate the bank reconciliation, these compressed figures are used to guide the automatic matching and automatic generation features based on the tender and bank reconciliation rules.

All transactions on a bank statement that relate to a card should be entered onto the card not through the bank reconcilation as a manual entry.

In respect to Visa/Mastercard/Amex Card statements, if the transaction on a bank statement has a card, enter a supplier debit against the card and expense it correctly then enter a supplier payment using the right tender to point to the right visa card ensuring both transactions are dated the date on the visa card statement. Other all other non stock miscellanous transactions that you dont have a card set up for, then you can enter via the Bank Reconcilations as either a deposit or payment ensuring to date these the date on the bank statement and expense correctly.

Getting Started

- Performing your first bank reconciliation just to bring in the opening balances for bank reconciliations

- Performing a bank reconciliation manually (not importing the bank statement)

- Setting up and using automatic bank reconciliations

- Automated Bank Reconcilation from a imported Bank Statement

- Reversing a bank reconciliation

Reference

Buttons

Refer to Common Buttons.

| Image | Field | Description |

|---|---|---|

| Extract Bankings | Extract readysell banking transactions into this bank reconciliation | |

| Import Transactions | Import bank transactions from the Exported Bank Statement into Readysell for automatic matching and automatic transaction generation | |

| Generate Corrections | Generate corrections for a banking that will create either a bank payment / bank deposit based on the value in the correction column. This action button should only be used for minimal variances usually where cash varies between what is banked and what is recorded in Readysell. If a transaction value for a source transaction has been entered incorrectly, ensure that you fix the source transaction on the card. | |

| New Banking | Create new banking in this reconciliation being either a bank deposit/bank payment or bank transfer |

Fields

| Field | Description |

|---|---|

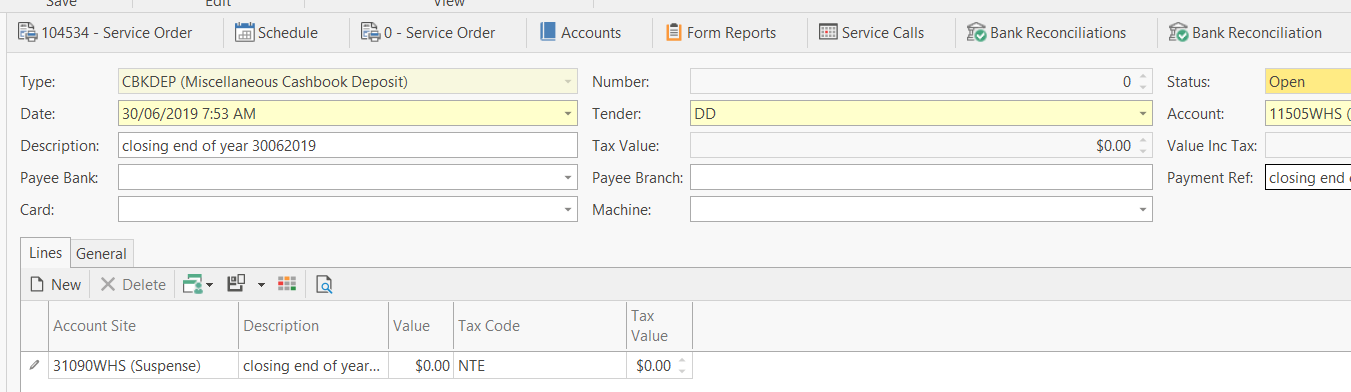

| Date | Date created for the Bank Reconciliation |

| Number | Bank Reconciliation transaction number |

| Status | Status of the Bankrec |

| Account Site | Bank Account General Ledger Account |

| Statement Open Date | The statement opening balance date for the Bank Reconciliation, This value is Populated from the closing balance of the last bank statement. |

| Statement Open Balance | The statement opening balance for the Bank Reconciliation. This value is Populated from the closing balance of the last bank reconciliation for that bank account. Equals Statement Closing balance from the previous bank reconciliation for that bank account |

| Unpresented Balance | Expected GL Closing Balance - Computed Closing Balance. The sum of the items not yet marked |

| Statement Close Date | The Statement Closing Date. This is a manual entry from the Bank Statement. The date you are last reconciling to. |

| Statement Close Balance | This is the statement closing balance for the Bank Reconciliation and is entered from the Bank Statement. This is not calculated. |

| Value Marked | The sum of the transaction value of marked Lines, this field shows the value marked for the Bank Reconciliation |

| Comp GL Close Balance | Statement Opening Balance + Total Value (all readysell transactions within the bank rec), also known as the 'expected General Ledger closing balance' |

| Comp Close Balance | Statement Opening Balance + Value Marked, this is the computed closing balance |

| Actual GL Close Balance | Bank Account GL Balance at Statement Closing Balance Date, this field shows the general ledger closing balance for this Bank Reconciliation |

| GL Variance | GL Closing Balance - Expected GL Closing Balance |

| Variance | Statement Closing Balance - Computed Closing Balance, aalso known as the "Statement Variance" |

Lines Tab

Buttons

| Image | Field | Description |

|---|---|---|

| Mark Selected | Mark the transaction highlighted within a bankrec. | |

| Unmark Selected | Unmark the transaction highlighted within a bankrec. | |

| Mark All | Mark all transactions highlighted within a bankrec. | |

| Unmark All | Unmark all transactions highlighted within a bankrec. |

Fields

| Field | Description |

|---|---|

| Date | The date and time of the banking (source record date) |

| Tender | The tender that was used for that source of banking |

| Site | The site of the banking |

| Workstation | The workstation for that source banking |

| Transaction Number | The source transaction number |

| Card | The card that relates to this banking |

| Description | The description of the source transaction |

| Payment Reference | This is the payment reference entered into the Customer Payment or Supplier Payment at the time of entry |

| Transaction Value | This is the transaction value for this line or the Sum of all transactions for the tender |

| Corrected Date | Manual entry of the date |

| Corrected Value | Manual entry of what the value should be. |

| Marked | Check this box to mark the line |

| Matched Reference | This is the matched reference value from the Imported Bank Statement |

| Value Excluding Fee | This line shows the value excluding fee for this line |

Buttons | |

| Show in report- Shows banking records in a report | |

| Show the original transaction that generated this banking | |

References | |

| Date | The date and time of the banking record |

| Card | The Cardid of the source transaction |

| Transaction Number | This is a unique transaction number for the source banking record |

| Payment Reference | This is the payment reference for the source banking record |

| Description | This field contains a short description of the source banking record at the time of entry |

| Presented date | The date and time that the payment was presented |

| Value | This field shows the value of the banking record within a bank reconciliation |

| Value Excluding Fee | This field shows the value of the banking record, excluding fees |