How the General Ledger Financial Reports display credits.

Overview

There are two conventions for the use of brackets on readysell financial reports

In some cases, a bracket is used to designate a credit and in other cases, a bracket is used to designate an exception

Explanation of Readysell financial reports:

When you run a Readysell General Ledger Trial Balance, any values that are a Credit will show in brackets.

- If for example on your chart of accounts, the account of Accounts Payable is set to display as a 'Credit' then when you run your general ledger trial balance the value will be in brackets.

When you run a Readysell General Ledger Balance Sheet and/or Profit & Loss this uses the Exceptions approach.

- If for example on your chart of accounts, the account of Accounts Payable is set to display as a 'Credit' then when you run your general ledger balance sheet or profit and loss the value will not show in brackets as it is an exception.

- If you wish to see such accounts displayed in brackets you will need to change the field on the chart of accounts for that account to display as a Debit.

if the general ledger account credit/debit is set to credit, then it will only show in brackets if it is not in credit

if it is set to be a debit, then it will show in brackets if it is not a debit.

See the link for a further explanation: http://www.accountingcoach.com/blog/use-of-parentheses

The table below will explain in more detail.

| "Normally Debit or Credit" Setting | Actual Balance on the account | Displays As |

|---|---|---|

| Debit | Debit | Positive |

| Debit | Credit | Negative (with Brackets) |

| Credit | Debit | Negative (with Brackets) |

| Credit | Credit | Positive |

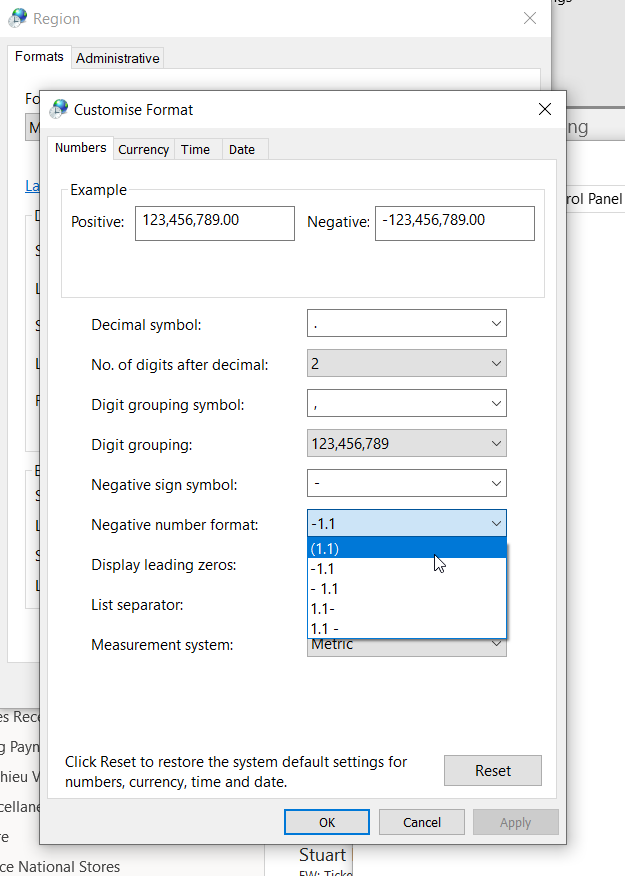

Based on your Windows settings is where you control the negative vs the brackets