Getting starting with machine profitability (labour costing)

Overview

In order to get a meaningful report on machine profitability from a management reporting perspective. We need to attribute a cost to all labour related to the machine. As labour can be a large part of the total cost for a machine. To do this we apply a notional hourly rate to the one or many labour products used in your business. Given that the true cost of labour is not known until you do your payroll run and that there is no way to allocate actual labour costs to particular machines. We do not want the notional labour cost to flow through to the profit and loss report. As a result we set the estimated costs on labour products to contra out in the general ledger. As a result your management reports can show a profitability by machine and your general ledger can show the true cost of labour from your payroll.

Procedure

- You will need to work out how many non stock product categories are required for your labour products

- You will need to work out what costing method you wish to assign to these non stock product categories. Usually the product supplier cost

- You will need to decide how many general ledger accounts you wish to set up for the non stock product labour categories eg you may wish to break the cost of labour by technicians or departments or just have one overall non stock gl account for the cost of goods for service.

- Check that the labour products have been set up correctly and are in the right non stock product category

If you are using the costing method of 'Product supplier cost' ensure that you have a supplier on the product and a costp1. - You may need to split products based upon what non stock product costing method you need to use.

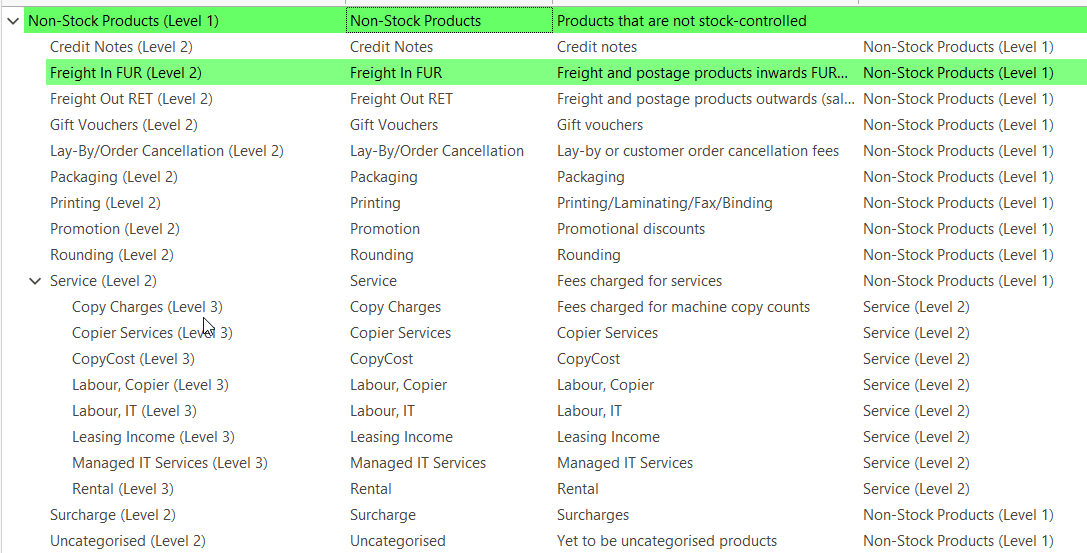

See example of a set up below:

You can have a Non stock Product Parent category called 'Service' and under service you can break up your labour costing non stock product categories if you wish

Non stock product category

- Set up the general ledger accounts required for the cost of goods side Creating/ Modifying a general ledger account

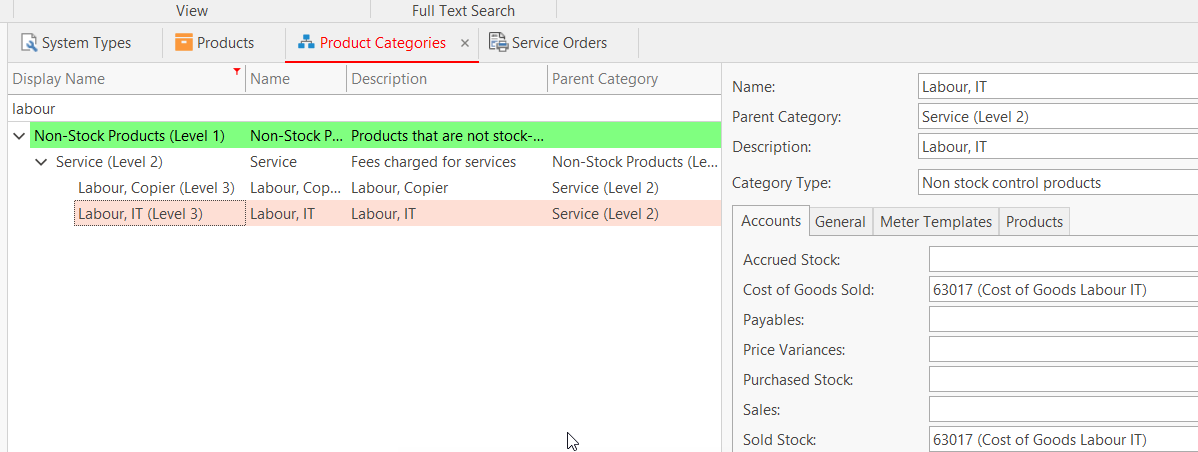

- Create the Non stock product category Product Categories

- Assign the cost of goods general ledger account to the Non Stock Product category for the Cost of Goods and Sold Stock, see example below

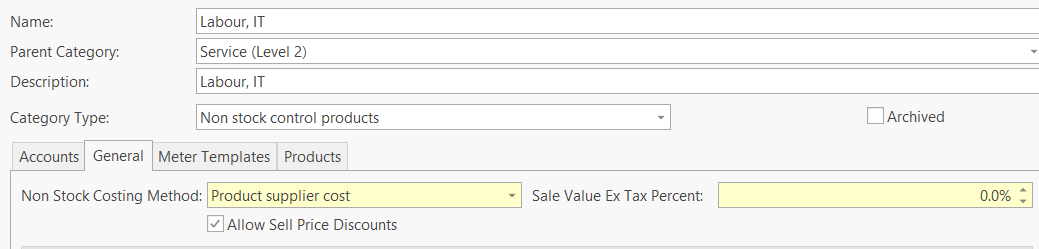

- Apply the costing method to the non stock product category by clicking on the Tab 'General'

for machine profitability you would use costing method of Product supplier cost

- Go back to each product and assign this non stock product category to it

Ensure that you have a supplier on the product and a costp1 before you insert a service order or sales order

The nett result for the general ledger cost of goods account will be zero, however there will be a cost affect on the Machine profitability report.