Overview

...

Overview

There is no way to make the discussion on how we cost transactions simple or easy to understand. But I will do my best. All the ways of costing are difficult or stuff up some of the time. We had to pick one, so we picked the one that works best most of the time. We have to live with the fact that our chosen costing method is not the best choice for some transactions.

...

Why is the cost on my sale order different to the cost on the invoice that was created from that order?

The cost on the sale order should not necessarily carry through to the invoice:

- The cost on the sale order is based on current cost at the time the order was placed:

- As at the time the order is placed, we don't know what the FIFO cost will be.

- FIFO cost will vary depending on exactly which purchase receipts have not been allocated at the time the invoice is posted.

- The cost on the invoice is based on FIFO cost at the time the invoice was posted:

- When the invoice is posted, we can pick which receipts to link to the invoice lines. So we know the FIFO cost for the first time when the invoice is posted.

Example:

Product A, nil in stock.

Customer Orders 1 x Product A = 1 x Product A on back order.

Product A primary supplier cost = $10.

Prodcut A sell price on Sales Order = $20.

Dollar margin on this salline = $10.

Purchase Receipt completed for 1x Product A at $5 (not $10).

Stock in x 1 at $5.00

SALLINE margin based on FIFO is now $15 (not $10).

Why one of the strengths of FIFO costing is it lets me I trace where my costs come from?

...

- Reverse the purchase invoice (and/or the purchase receipt. You only HAVE to reverse the purchase invoice). Then reenter the purchase invoice and adjust the value of the purchase invoice to reflect the cost price you SHOULD have paid. Put a note in the supplier reference saying this invoice includes the effect of the financial adjustment:

- Strength: the price on the product received will be correct

- Weakness: the supplier open items will show only one open item for the purchase invoice

- Strength: the price on the product received will be correct

- Weakness: the supplier open items will show only one open item for the purchase invoice. There will be no seperate entry for the financial adjustment

- Weakness: you can only do this if the financial period of the purchase receipt has not yet closed.

- Enter the financial credit as a supplier credit transaction and dissect the general ledger effect to supplier rebates received

- Strength: two supplier open items will appear on the supplier account. One for the origional invoice and one for the financial credit

- Weakness: the cost on the product will permanently stay as per the incorrect cost specified on the origional purchase invoice

A contract price setup with markup from cost of zero can result in a sale with negative margin. Why can the sell be less than the cost when the contract says to sell at cost?

- The normal approach is to use markup from cost. This creates a sell price that is based on the current replacement cost of the product. But the cost price is still based on FIFO cost for all sales. Given the cost basis used to calculate the sell price is different to the cost basis used to calculate the actual cost of the sale. The sell price from standard cost can be less than the fifo cost from past receipts. See the first

- . There will be no seperate entry for the financial adjustment

- Weakness: you can only do this if the financial period of the purchase receipt has not yet closed.

- Enter the financial credit as a supplier credit transaction and dissect the general ledger effect to supplier rebates received

- Strength: two supplier open items will appear on the supplier account. One for the origional invoice and one for the financial credit

- Weakness: the cost on the product will permanently stay as per the incorrect cost specified on the origional purchase invoice

A contract price setup with markup from cost of zero can result in a sale with negative margin. Why can the sell be less than the cost when the contract says to sell at cost?

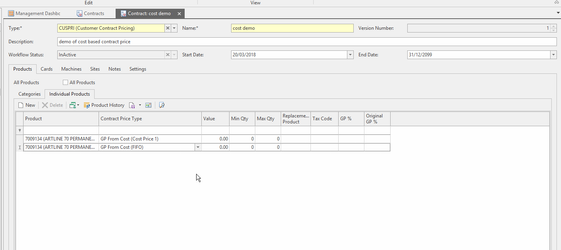

- The normal approach is to use markup from cost. This creates a sell price that is based on the current replacement cost of the product. But the cost price is still based on FIFO cost for all sales. Given the cost basis used to calculate the sell price is different to the cost basis used to calculate the actual cost of the sale. The sell price from standard cost can be less than the fifo cost from past receipts. See the first line in the example below. This shows a contract price from cost price 1 on the top line. The first line in this contract will not change the sell price when sale shipments are posted. But the FIFO costing will change the cost on the line. So the cost can end up more than the sell price. But sell price stays the same.

| Expand | ||

|---|---|---|

| ||

- To get around the problem above, you can make a contract be based on markup from FIFO cost. But if you do this. When the sale shipment is posted. The FIFO cost will be calculated and the SELL PRICE WILL CHANGE. Resulting in the sell changing to be different to that sell price that showed on the sale order. We normally just use this for staff. See the second line in the example below. This shows a contract price from cost price 1 FIFO on the top second line. The first line in this This contract will not change the sell price when sale shipments are posted. But the FIFO costing will change the cost on the line. So the cost can end up more than the sell price. But sell price stays the sameprice will never be less than cost. But since FIFO cost changes the cost of the shipment when the shipment is posted, the sell price of any shipments will probably change when the shipment is posted. The sales will not sell for less than cost, but the sell price will change when the shipment is posted.

| Expand | ||

|---|---|---|

| ||

- To get around the problem above, you can make a contract be based on markup from FIFO cost. But if you do this. When the sale shipment is posted. The FIFO cost will be calculated and the SELL PRICE WILL CHANGE. Resulting in the sell changing to be different to that sell price that showed on the sale order. We normally just use this for staff. See the second line in the example below. This shows a contract price from FIFO on the second line. This contract price will never be less than cost. But since FIFO cost changes the cost of the shipment when the shipment is posted, the sell price of any shipments will probably change when the shipment is posted. The sales will not sell for less than cost, but the sell price will change when the shipment is posted.

| Expand | ||

|---|---|---|

| ||

Costing of stock moved between two product codes with different product units

...

Costing of stock moved between two product codes with different product units

- Stock adjust out all the stock that is going to be changed to the other product code from the existing product. FIFO costing will cost the stock adjustment as it is consuming stock on hand

- Make sure the cost price 1 on the product you are moving the stock too has the right each cost in it. As stock adjustments use the cost price 1 of the primary product supplier to set the cost of stock increases from stock adjustments. If necessary adjust the cost price 1 on the second product to get what ever cost you want.

How do I see how the cost was assigned at time of sale shipment/sale invoice?

On the Sale Shipment

Select the products, one by one, that have a question about costing used on the sale shipment.

On the Sale Invoice

Select the products, one by one, that have a question about costing used on the sale shipment.

See Also:

Correcting Shipments that have been receipted with incorrect costing.

Reversing a receipt when QOH is insufficient

...